Wills Lawyers Brampton

A will is a legal document that directs how you wish your estate administered, subject to some limitations described below, and who your chosen beneficiaries are. The will is an important document that is used in the probate process after your death to ensure that all of your assets are given to the rightful beneficiaries as per your wishes and instructions. Dying without a will, will cause delay and expense to your loved ones. A power of attorney is an instrument that gives another person the power to act on your behalf while you are alive. At its simplest the difference between wills and powers of attorney can be explained as a will is effective upon your death, a power of attorney is effective (usually) while you are alive. Powers of attorney are governed by the Substitute Decisions Act. This statute was passed in Ontario in 1992. The Substitutes Decisions Act establishes two kinds of powers of attorney, one being a power of attorney over the person thereby enabling the attorney to make medical and other vital decisions for an incapable person, and the other is a power of attorney over property. Under the previous law, if a person became incapable of managing his or her estate and affairs, either by virtue of physical or mental disability or incapacity, there were three possible results, namely:

Estate Planning

Certain taxes will be triggered under the deemed disposition rule. Careful advice and planning may reduce or avoid this.

Trusts

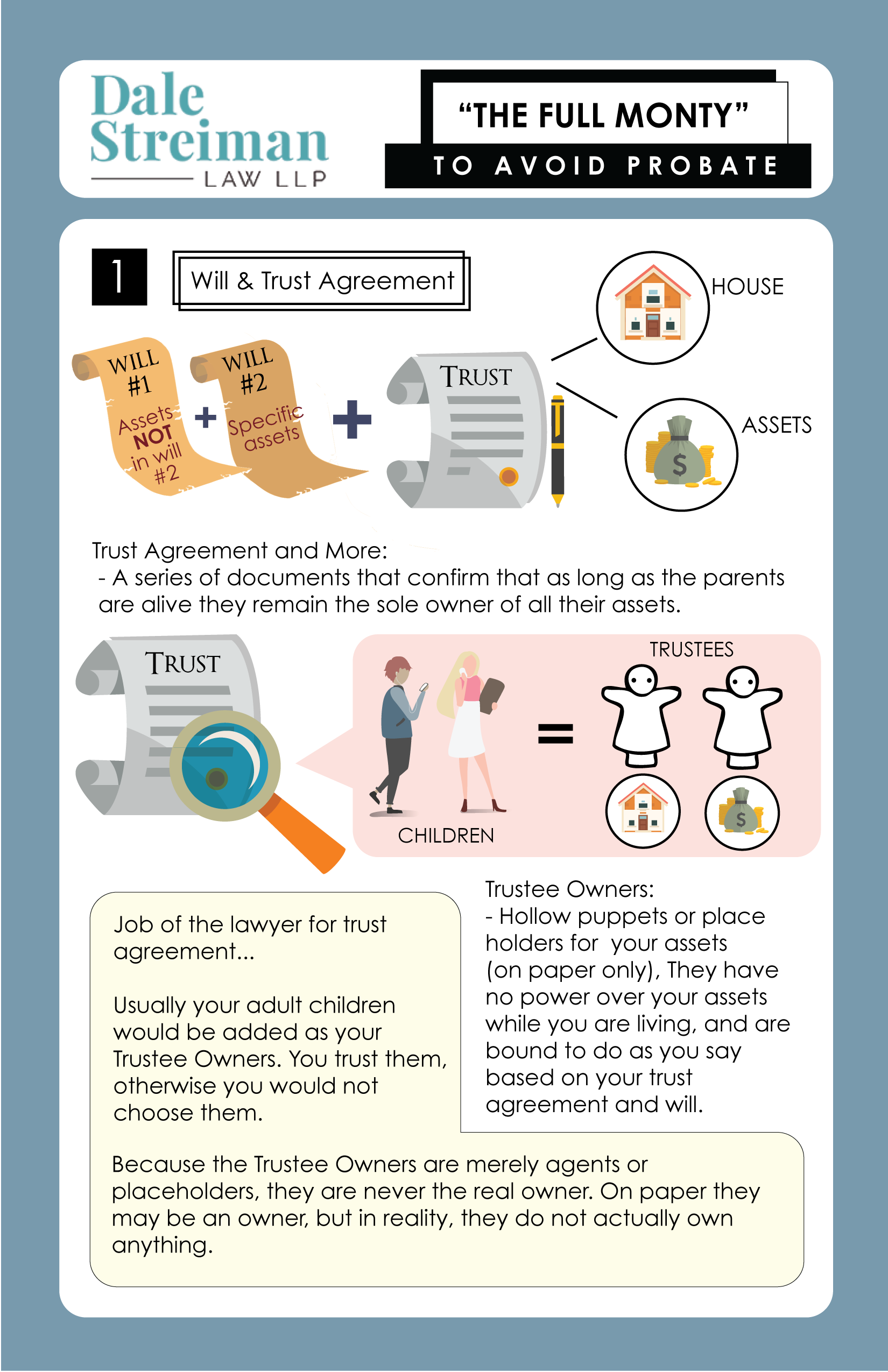

Generally, a trust is a right in property (real or personal) which is held in a fiduciary relationship by one party for the benefit of another. The trustee is the one who holds title to the trust property, and the beneficiary is the person who receives the benefits of the trust. A carefully crafted trust agreement along with a will or wills can be very beneficial and lead to a significant saving of probate fees.

Wills

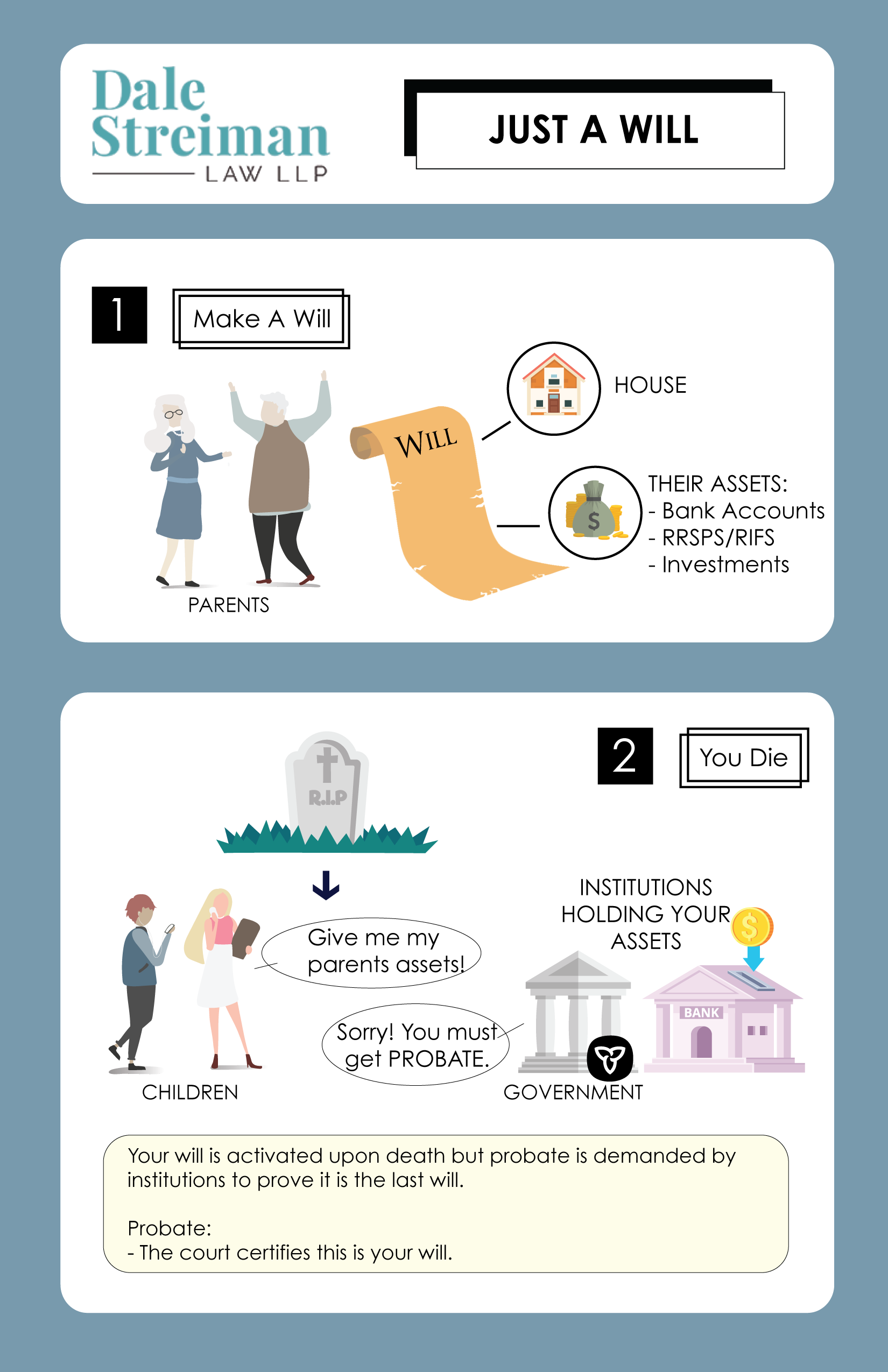

A will is a legal document that directs how you wish your estate administered and whom your chosen beneficiaries are. The will is an important document that is used in the probate process after your death to ensure that all of your assets are given to the rightful beneficiaries as per your wishes and instructions. Dying without a will, will cause delay and expense to your loved ones.

People often confuse the difference between these two documents. A will is the method by which you decide how your assets on death are distributed subject to some limitations described below. A power of attorney is an instrument that gives another person the power to act on your behalf while you are alive. At its simplest the difference between wills and powers can be explained as a will is effective upon your death, a power of attorney is effective (usually) while you are alive. Powers of Attorney are governed by the Substitute Decisions Act which Governs Powers of Attorney. This Statute was passed in Ontario in 1992. The Substitute Decisions Act establishes two kinds of Powers of Attorney, one being a Power of Attorney over the person thereby enabling the Attorney to make medical and other vital decisions for an incapable person, and the other is a Power of Attorney over property. Under the previous law, if a person became incapable of managing his or her estate and affairs, either by virtue of physical or mental disability or incapacity, there were 3 possible results, namely:

- A court application at considerable cost, to have that person declared incapable and obtaining of a Court Order appointing a representative, called a “Committee” to tend to that person’s affairs.

- If the person being deemed incapable, i.e. mentally ill or otherwise incapable, had signed a continuing Power of Attorney prior to the occurrence of the disability, the named attorney would then have the power and authority to manage and deal with the incompetent person’s affairs.

- If no Power of Attorney was in existence and until an application was brought to a Court to have a Committee appointed for such person, the office of the Ontario Government, namely the Public Trustee would be appointed and manage the incompetent’s affairs. The appointment of a Public Trustee in the former law and now under the present law also being a possibility, is most unsatisfactory, for both immediate family and the person being incompetent. Since the law came into force, a change was made not requiring the government to be asked to make medical decisions such as transfusions and need for operations in absence of the new Power of Attorney for Personal Care. Immediate family members, such as the spouse or children of the person granting the power of attorney may make such decisions.

In addition, the person granting the power of attorney may make “living will” decisions, such as deciding not to be resuscitated in event of no possibility of recovery from life threatening conditions. Now it is legally possible for anyone 16 and over to give a friend or relative power of attorney to make decisions on personal care issues – involving health care, nutrition, shelter, clothing or safety – if the person is unable to take care of these things. With respect to wills, it should be pointed out to Ontario Residents that persons with life insurance, pensions or other plans which designate a beneficiary should generally NOT designate the “Estate” the beneficiary of such RRSP’s, pensions, life insurance policies but rather specific parties. These are exception but these must be carefully discussed with your lawyer.

A Strategy To Reduce Or Eliminate Probate Fees - Fully Monty

HOW TO USE A TRUST TO SAVE THOUSANDS OF DOLLARS IN PROBATE FEES.

This strategy is driven by 2 primary goals. We call this strategy the Full Monty.

To arrange for an orderly estate succession (what happens after you die) and minimize estate administration tax, also known as probate fees. An additional benefit can be a reduction in exposure to potential creditors.

SOME BASIC PRINCIPALS.

A “Testator” is the formal name of the person making the will, whose death activates the will.

A “third party asset holder” is usually an institution that is holding an asset for someone. A prime example would be a bank maintaining a bank account for the testator. Another common third party asset holder is the Province of Ontario which maintains a land registry system controlling the registration of owners of real estate.

The “Attorney” in Powers of Attorney does NOT mean a lawyer, rather it is the person granted the authority to act on your behalf while you are alive.

“Probate” is the process by which the Superior Court of Ontario formally appoints someone to represent the estate, the executor or estate trustee and seals and certifies that a will is indeed a person’s last will and testament subject to a later claim.

- The main purpose of “PROBATE” is to both formally appoint an individual as the estate trustee, also known as “executor” and, in the case of such an appointment with a will annexed, it certifies to the world that this indeed is the late testator’s last will and testament.

- Simply put, it is the method by which, for all third party asset holders, a will is certified to be the last will of the deceased and can be acted upon.

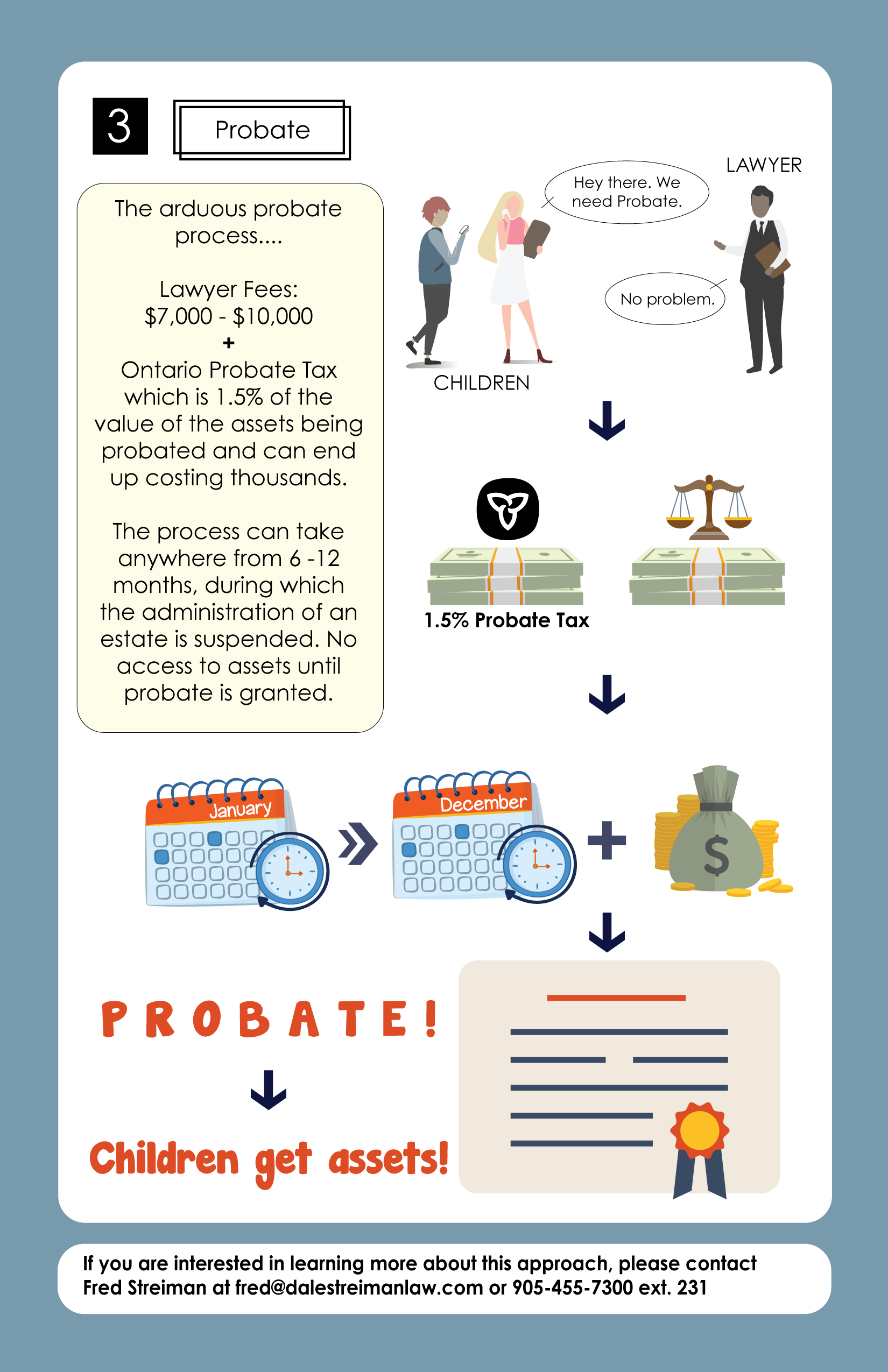

- However, the Province of Ontario, in return for the granting of Probate, formally known as a Certificate of Appointment of an Estate Trustee, either with or without a will annexed, will levy an estate tax roughly equal to 1.5% of the value of the assets being probated.

- By a combination of a series of documents and transfers which are set out in greater particularity below, the need to pay this probate tax is reduced and/or eliminated.

- In the era of million dollar homes being common place, the probate fees saved can easily exceed $10,000.00 or more. Another benefit is that it avoids the laborious and time consuming process of applying for probate in many instances.

- Probate, especially one centered in the City of Toronto is a process that can easily take in excess of 6 months during which the administration of an estate can be suspended. Even determining what the assets are can be caught in this lengthy never never land.

The documents involved include the following:

- Primary will. This is the will in which assets that cannot be protected from tax are subject to probate fees. This is a rare asset. An example would be an asset that the testator obtains after the Full Monty is created and no steps are taken to bring it under its control.

- Secondary will. This is one of the two primary document engines that accomplish the entire thrust of this process. A secondary will is the will that deals with those assets to which probate need not apply. An example would be shares in a privately held corporation or property held in trust for the testator by others. This would include a piece of real estate owned jointly owned with others, often family members but with a trust agreement confirming that beneficial ownership remains solely in the hands of the testator.

- Power of attorney for property. This is a crucial document and, in its absence the only alternative is an extremely expensive court application for the appointment of a guardian of property. Of course, one must recall that the essential difference between a power of attorney and a will is that the power of attorney grants power and is only effective during the life of the grantor, but a will disposes of assets and only takes effect upon death.

- Power of attorney for personal care. This is the document that grants to the attorney the ability to make vicarious decisions for one’s health which includes residence as well as medical decisions.

- An extensive multi page trust agreement. The other primary document along with the secondary will. In this agreement, both the beneficiaries and the trustees sign and acknowledge that the assets that are specified in the agreement, which will often include the primary residence of the testator and various liquid assets irrespective of ownership still remain solely and beneficially owned by the testator until death. Upon death, these assets fall into the secondary will (and if you recall, this is the will that is not subject to probate and probate fees) and are so distributed.

- Transfer(s). Title to any real estate one wishes to be covered under the aforementioned trust agreement and secondary will would be transferred. Here one would typically convey a family home into the name of the parent(s) along with some of the trusted children as joint tenants. Upon the death of the last of the parent(s), title remains solely in the names of the surviving children. However, the children are acting merely as trustees and the trust agreement mentioned above confirms that the home is to be dealt with in accordance with the terms of the secondary will.

- Trust declaration for the purposes of land transfer tax. This affidavit is required so no land transfer tax is triggered by the transfer of real estate.

- Transfer of liquid assets. If liquid assets, such as savings accounts are to have trustees added to them as owners, these are listed in the aforementioned trust agreement and further will require transfers to be done by both the beneficiary and trustees at the institution.

We have to point out what can go wrong. Primarily, the inter-relationship between the beneficiary (usually the parent) and the trustees (usually the child(ren)). While formal beneficial ownership always remains with the donors or testator, in the event of a conflict with a child, this may require the intervention of a court to enforce the terms of the trust agreement.

The trust agreement is the lynch pin and the formal declaration by all concerned that irrespective of the transfers, the beneficial owner remains the donor, usually the parent(s). This process is not appropriate when there is no close and reliable relationship between beneficiary and trustee. However, in the instance of a close family network, especially as the donors become older, this is a practical and beneficial process for all concerned.

Also the trust agreement protects the assets from being claimed by ex-spouses of trustees or their creditors. It also permits the trustees who may own their own primary residence to maintain the capital gains exemption for everyone’s residence.

The cost is generally similar to the fees we charge in administering an estate. The probate fees are an outright saving. If you are interested in learning more about this approach, please contact Fred Streiman at Fred@dalestreimanlaw.com 905-455-7300 ext. 231

To learn more check out the article – A Strategy To Reduce Or Eliminate Probate Fees – Fully Monty