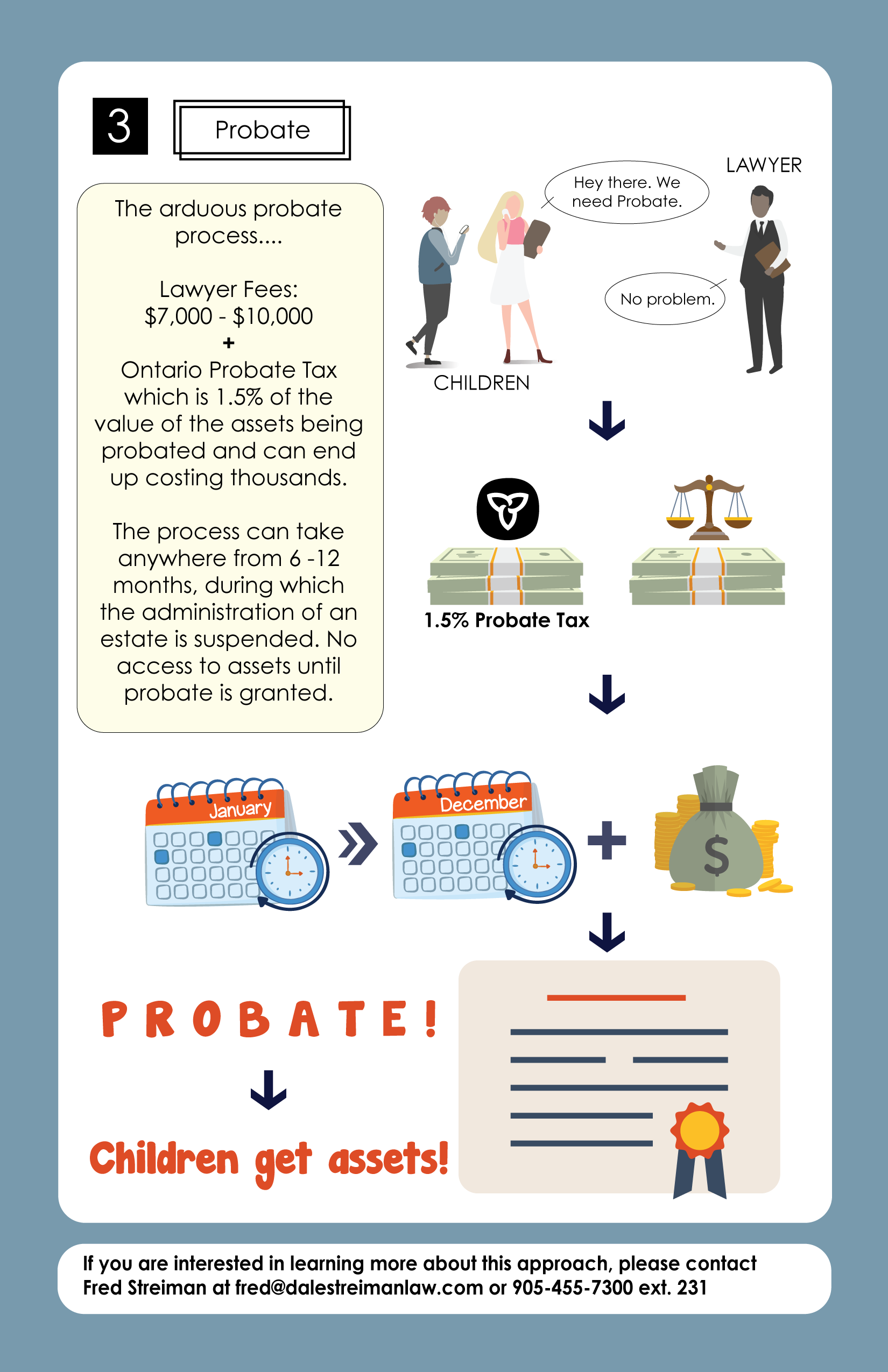

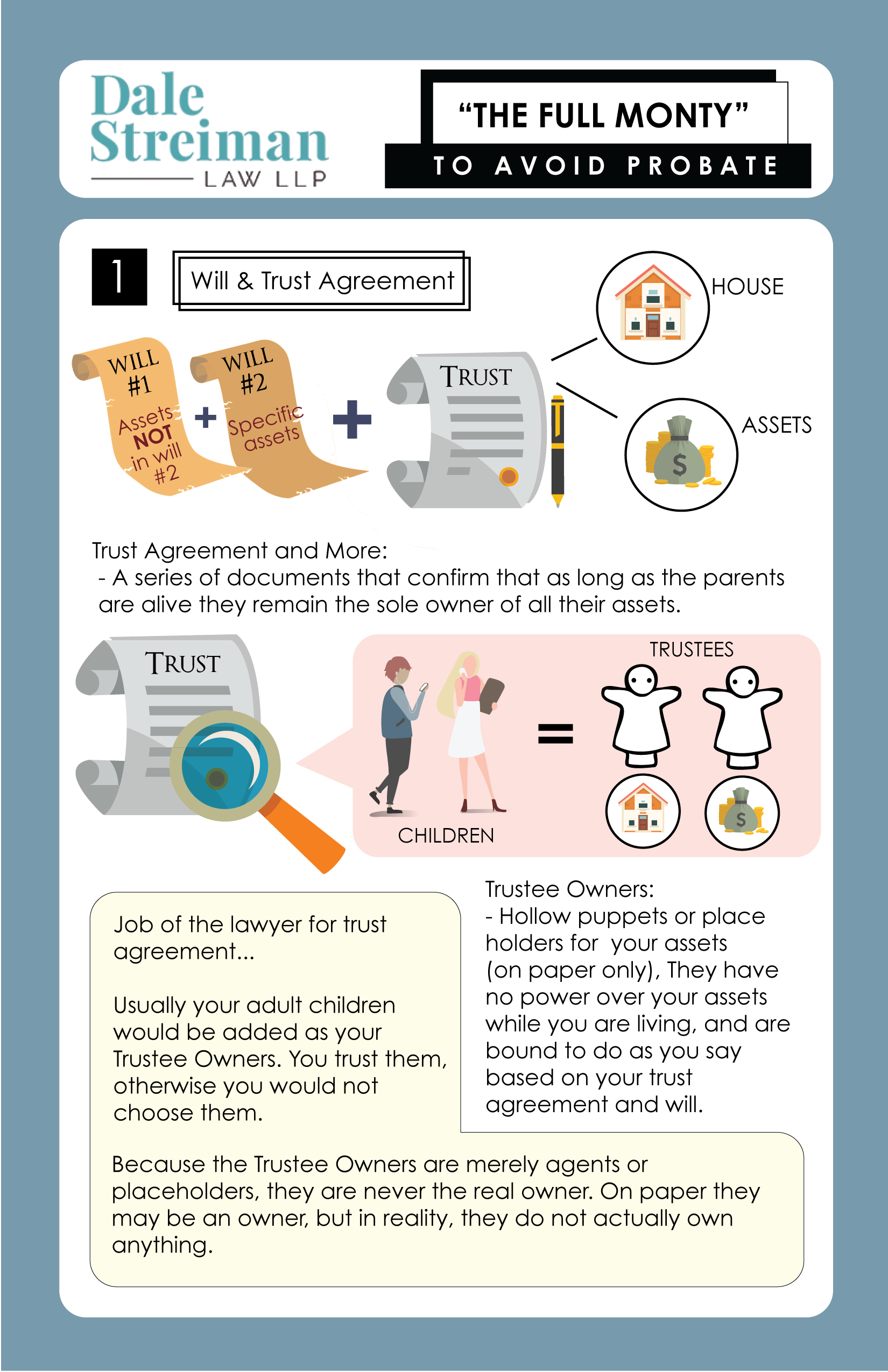

At our law firm we have devoted a fair amount of time to perfecting our strategy to avoid or eliminate probate. We have called that strategy the “Full Monty” and it is explained elsewhere on this website.

Learn More : A Strategy To Reduce Or Eliminate Probate Fees – Fully Monty

Learn More : The Full Monty

In the May 2, 2022 decision of Madame Justice Sally Gomery of the Ontario Superior Court of Justice she explored this issue.

Sheila Selkirk died and left behind a set of dysfunctional children. What should have been resolved over a cup of coffee instead became a long winding road of disharmony, distrust and division.

Some interesting and novel legal arguments were made, but quite frankly from this observer’s perspective, the position being taken by the unhappy beneficiary siblings was a loser from the very start.

However, the case does stand for the proposition that properly appointed attorneys under a Power of Attorney for property can enter into a trust declaration for property owned by a mentally incompetent donor. That is more fully explored in our Blog titled – Can a Power of Attorney be used for entering into a Trust agreement including the Fully Monty. That is more fully explored in our Blog titled – Can a Power of Attorney be used for entering into a Trust agreement including the Fully Monty

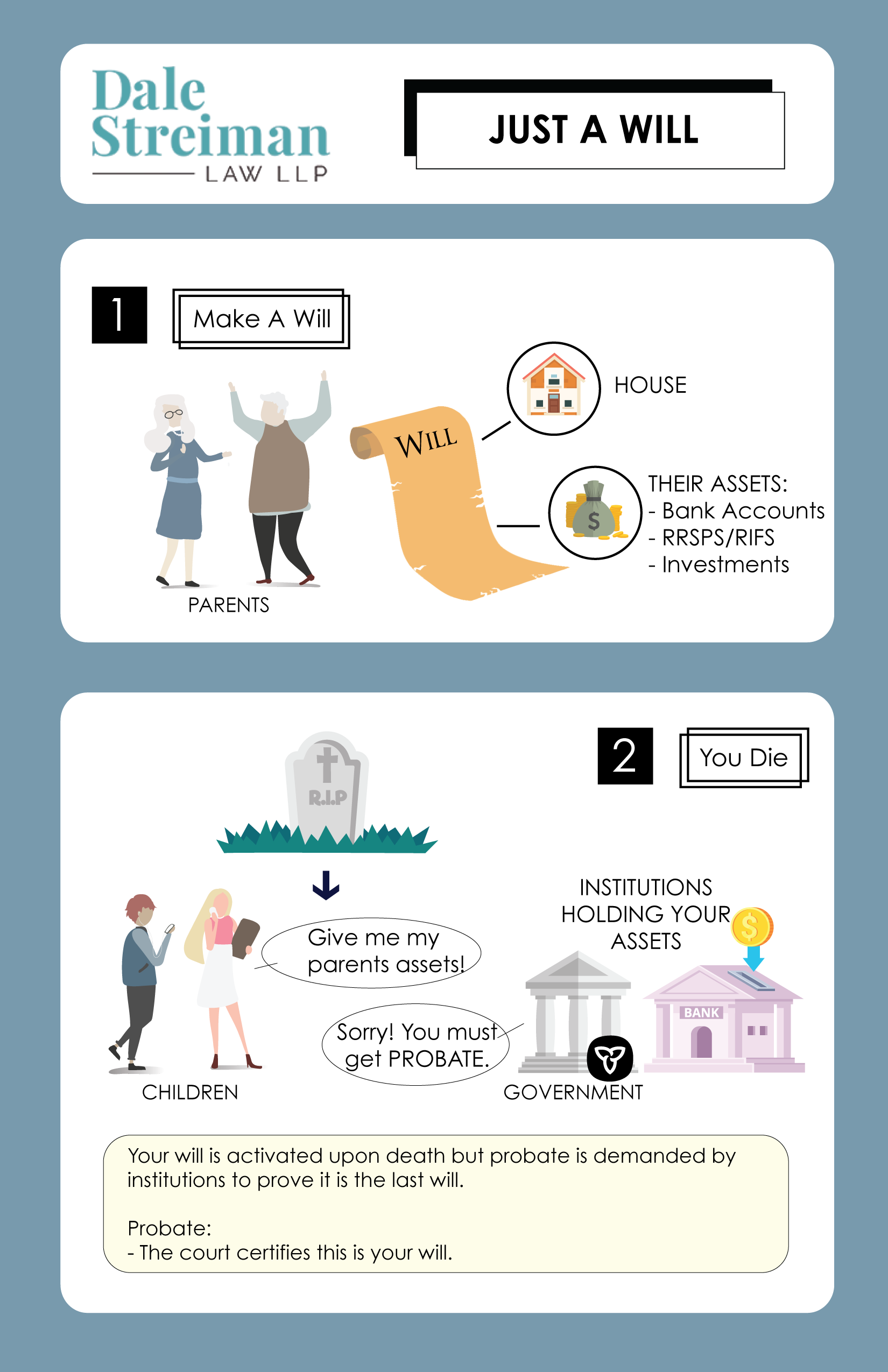

Let’s break this down into a concrete example such as in Selkirk so that one can understand this legal mumbo-jumbo. We have a widow who owns a house and she has a number of children. She already has a Will in which while she largely divides her estate equally amongst her children, but she wants a loan made to one of the children to be repaid before they get their share. The mother told a few of her children that she wanted to avoid probate and its expenses. However the mother lost her mental capacity shortly before she died and was not able to sign anything.

The brothers went to see their lawyer who prepared a Trust Agreement. The Trust Agreement unfortunately was far briefer and less detailed than the document that our office prepares. The Trust Agreement simply indicated that two children were to be added as joint tenant owners of the home in addition to the ailing mother. The brothers using the Power of Attorney granted to them signed on behalf of their ailing mother. The trust declaration simply indicated that their mother remained the sole beneficial owner, but did not say what was to happen upon her death.

The unhappy beneficiaries after mom died tried to argue that she had explained and promised to all that when she died she wanted her house sold and the net proceeds simply divided equally amongst all of the children.

This argument was doomed to fail from the begin. Nothing was in writing, the Will was not changed nor could the mother’s existing Will have been changed at this stage of her life.

The case is littered with terrible cross allegations between the siblings of theft and other misdeeds and one cannot but help be saddened and shake their head over a family torn apart over a modest amount of money. The house in question upon sale only realized $326,000. Divided among six people, this is hardly life-changing. On the other hand, it does provide an interesting factual backdrop, but at what emotional expense.